When you’re looking to buy a home that’s under the Greenbelt program what does that mean for you as a buyer? If not handled properly you could end up paying thousands out of pocket later. When a property is removed from the Greenbelt program it’s subject to rollback taxes and the amount you pay each year for property taxes will go up.

In 1976 the Tennessee General Assembly put the Agricultural, Forest and Open Space Land Act of 1976 in place, which is commonly referred to as “Greenbelt”. The purpose of this Act was to help preserve land in its current state and valuing the land based on that present use and not the highest and best use. As a result of the present use valuation, there is typically property tax savings for the property owner.

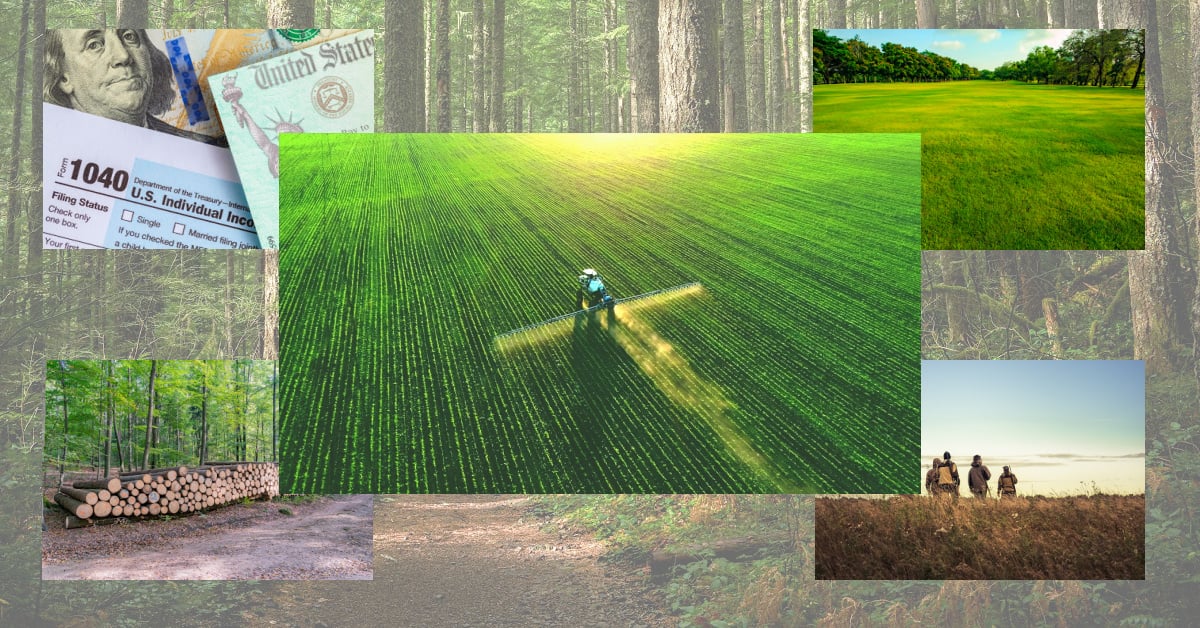

Types Of Land That Qualify

– Agricultural Land

Must be at least 15 acres and can include woodlands or wastelands. The land must be producing or growing agricultural products; for example – growing any crops (corn, tomatoes, potatoes, cucumbers, etc), raising animals (selling eggs from chickens, raising cattle for milk or beef, goats, etc). If claiming your land as agricultural it must produce an average of $1,500 per year over a three-year period or have been farmed by the owner or owner’s parents for at least 25 years and be used as the primary residence for the owner.

– Forest Land

Must be at least 15 acres and have enough tree growth to be considered a forest. You must have a forest management plan that is submitted with your application. The state provides a forest management plan template that you can use however I highly recommend seeking the assistance of a professional forester. The Divison of the Forestry has a list of recommended foresters you can choose from. Most forest management plans are good for at least 10 years but that can depend on who prepares the plan and the county you reside in.

– Open Space Land

Must be at least three acres characterized by an open or natural condition and whose preservation would be of benefit to the public. The local planning commission for your county must designate the area for preservation in order for the land to qualify for the Greenbelt program.

Examples of benefiting the public would be:

– The use, enjoyment, and economic value of surrounding residential, commercial, industrial, or public use lands.

– The conservation of natural resources, water, air, and wildlife.

– The planning and preservation of land in an open condition for the general welfare.

– A relief from the monotony of continued urban sprawl.

– An opportunity for the study and enjoyment of natural areas by urban and suburban residents who might not otherwise have access to such amenities.

Tax Advantages

Once the property is qualified for the Greenbelt program the value is then based on its present use which often results in a lower property tax assessment lowering your yearly property tax bill. The type of land and the county you reside in determine how much savings you could potentially see on your taxes.

Rollback Taxes

Because you are potentially saving money on your property taxes by participating in the Greenbelt program there could be a charge for previous years’ taxes should you decide to terminate participation or sell your property. The rollback taxes are usually calculated for each year of the last three years for property under the agricultural and forest land program. Open space land is calculated each year for the previous five years. If you are thinking about selling your property that is under any Greenbelt program discuss with your real estate agent or attorney about potential rollback taxes.

Be sure to check out the State of Tennessee Greenbelt article for any additional information or updates. The State of Tennessee Greenbelt Manual can be found here – Greenbelt Manual.

As the Greenbelt program is created by law you may want to seek legal advice or tax advice when deciding whether applying for Greenbelt is the best choice for you. You may also wish to review the State Board of Equalization’s Greenbelt Manual which has many examples and helps explains portions of the Greenbelt program.