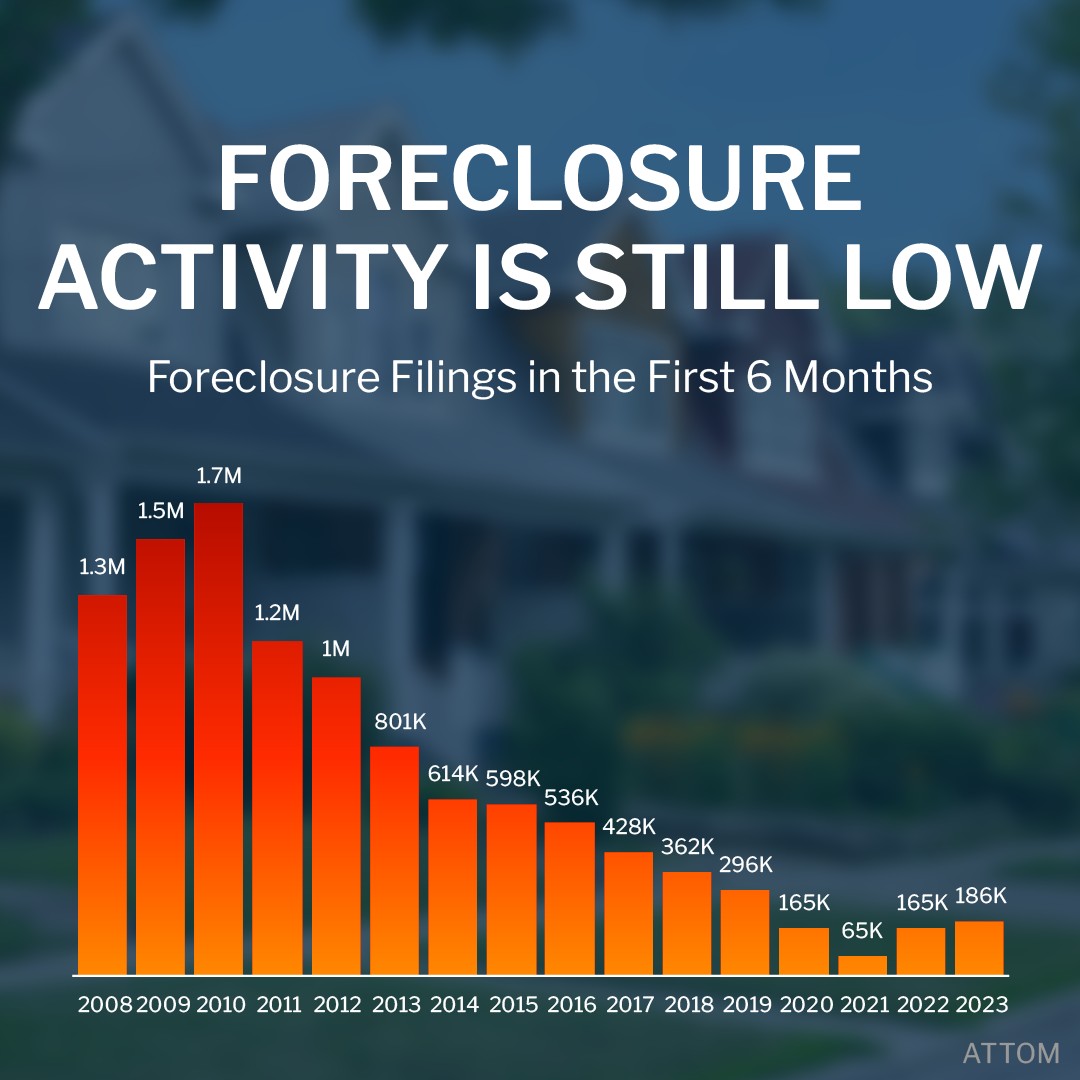

In recent weeks, there has been a noticeable uptick in foreclosure filings. Headlines have zoomed in on this increase, causing some concern among homeowners and potential buyers. However, a deeper look into the data shows that the current state of foreclosures is still below historical averages, particularly when compared to the crash of 2008.

Foreclosure Filings: A Brief Overview

Foreclosure is a legal process that allows a lender to take possession of a property when the borrower fails to make mortgage payments. Foreclosure filings are the initial step in this process and are a key indicator of economic distress.

The Recent Increase: Cause for Concern?

While the recent increase in foreclosure filings has been noteworthy, it is essential to put these numbers in context. Even with the rise, the current levels are significantly lower than what we would usually see in the market, especially compared to the high numbers witnessed during the 2008 financial crisis.

Why is this important? Because an abundance of foreclosures in the market can lead to a fall in home prices, affecting both sellers and buyers. A decrease in home values may sound appealing to potential buyers, but it can also signal a less stable market.

Comparing Today’s Market to 2008

It’s human nature to draw parallels between historical events, and the 2008 housing crash is still fresh in many people’s minds. However, there are key differences between then and now:

- Lending Practices: In 2008, loose lending practices contributed to a bubble in the housing market. Today’s lending standards are more stringent, reducing the risk of a similar collapse.

- Economic Environment: The 2008 crash was marked by a series of complex financial events that triggered a global recession. The current economic environment, though not without challenges, has distinct dynamics that don’t mirror the precursors to the previous crash.

- Government Response: The government has implemented various relief programs and regulations to support homeowners during economic uncertainties, reducing the risk of a wave of foreclosures.

What This Means for You

If you’re a homeowner thinking of selling, or a prospective buyer eyeing the market, the current state of foreclosure filings doesn’t necessarily spell disaster.

- For Sellers: Home prices remain relatively stable, and there’s no immediate threat of a wave of foreclosures devaluing properties.

- For Buyers: While there may be some increase in foreclosures, it’s not likely to cause a significant drop in home prices.

The recent headlines about increased foreclosure filings may be unsettling, but understanding the context provides a more balanced view. Today’s market is marked by differences that set it apart from the situation in 2008.

If you’re contemplating a move in real estate, don’t let fear guide your decisions. Speak with real estate professionals who understand the market’s intricacies and can provide tailored advice.

While we must keep a watchful eye on the trends, the current data on foreclosure filings is no cause for alarm. Instead, it serves as a reminder to approach the housing market with informed consideration, grounded in the realities of today’s unique economic landscape.

—

Interested in discussing your real estate needs? Feel free to reach out and let’s talk about why today’s market isn’t like 2008. #foreclosures #sellyourhouse